These 10 Frugal Money Saving Ideas for Family Vacation just might help you get you and your family on that dream vacation you’ve day-dreamed right there at your desk for every day.

Here’s the best part…

You don’t need to make extra money to make it happen.

Yeah, that’s right.

No side job, no part-time job, no weekend job.

At least no extra money making ideas on this post. (HINT- stay tuned for a future post on easy money making ideas to add money to your vacation savings account).

Let’s just take the 100% painless approach today.

Some of these ideas helped me go on my favorite trips, some I researched.

10 Frugal Money Saving Ideas to take your Family on Vacation (…without Working Anymore Than You Already Do)

1. Dedicated Vacation Savings Account

HUGELY important! Never mingle funds when saving for something important. And for me nothing’s more important than vacations. I personally have two savings accounts with two different banks (one’s a credit union from my job). I save for vacations in the credit union savings account because it’s more inconvenient to access the money. Out of sight out of mind.

[Advanced Vacation Savings Account Tip]: Place the money in an account in an account you’d have to go out of your way to withdrawal it.

Examples: online savings bank account, money market, bank or credit union with few branches (especially at branch far from the house and out of the way from work).

2. Direct Deposit in the Vacation Savings Account

This frugal money saving idea adds onto the first one. Don’t mingle funds or you’ll lose track of what money to earmark for vacations and what goes for regular daily expenses. To ensure that happens set up a direct deposit straight to your bank or credit union account.

2 Ways to Direct Deposit to Vacation Savings Account

- Set up direct deposit to siphon money from your paycheck to this separate account.

- Automatic transfer from your checking account where you deposit your work-earned money to the vacation savings account.

3. Credit Card Reward Programs

This is NOT one of the frugal money saving ideas suitable for everyone. If you carry credit card balance that weighs on your soul that hovers over your head like a black cloud- then DO NOT use credit cards to save for vacations. (please!)

If you can pay off the expenses immediately, at the end of the week or at least at the end of the month then I have found success earning cash back with the Chase Freedom Credit Card (especially the reasonable quarterly 5% back rewards- right now at the time of writing this post you get 5% cash back for gas and groceries).

Only use credit cards towards regular budgeted items you already have money for like groceries or gasoline. I wouldn’t recommend this idea for dining out or non-regular expense items. This defeats the purpose of savings. Then you’ll end up spending more money than you had planned. You risk ending up in debt.

I turn to Southwest Rapid Rewards credit card as my other go-to rewards credit card. The welcome bonus for opening up a new card ended up giving me 2 round trip tickets to California from Florida (Southwest flights).

I earned 50,000 Southwest Rapid Rewards points (now it’s 40,000). In low season I can fly from Orlando to LAX, SD or SFO for under 15,000 points (one person). Out of pocket expect these tickets to reach between $300 to $400 each. Please note that on Southwest you cannot reserve specific seats for free.

4. Eliminate Extra, Unnecessary Luxury Items or Services

Or perhaps get rid of them for good if you don’t use them. Gym memberships, cable, any kind of subscription you don’t really use, extra cell phone services like large data plans or extra lines, website memberships…you get the idea.

Find things that if you had to choose you’d choose the vacation instead. Monthly expenses add up to A LOT. Yes, that $20 membership seems small, but multiply that by 12 months and it reaches to $240. Then add the other 2 or 3 monthly fee services (whatever they are for you) and you might find $50 additionally monthly amounts which give you $600 per year.

So which do you want? How badly do you want to take your family on vacation?

If you don’t use it, you don’t need it. Get rid of it.

[Advanced Frugal Money Saving Ideas for Eliminating Luxury Items]

- Don’t want to eliminate a membership entirely then reduce it to a more basic service.

- Eliminate it for just a few months, until you’ve saved enough for the vacation.

- Purchase the item semi-annually or annually to earn a discount. (I do this for my Progressive auto policy. I save up to $300 per year).

5. Coins Jar…and extra dollar bills too

One of the simplest, painless frugal money saving ideas I’ve used to separate $50+ for vacations. Anytime you receive coins (or find them on the ground) as change when you purchase something drop them in the jar. Place that jar out of reach so it doesn’t tempt you to pull money out.

I currently have 3 jars hidden at the bottom of my closet which I’ve saved for over 3 years. I don’t even use cash much and have saved well over $100. If you don’t use cash much than make then take advantage of the next tip on this frugal money saving ideas list.

6. Weekly Cash Withdrawal Budget

To ensure you stick to a tight budget and avoid using your bank or credit card for tempting, unnecessary expenses pull out cash equal to your weekly allowance. Only spend this cash on your out-of-the-house items other than your set bills (energy expenses, insurances, rent, mortgage, phone, etc).

If you run out, then you must wait until next week to withdrawal money.

And whenever you get coins from your purchases take advantage of number 5 on this list.

7. Refunds

Deposit all refunds into your vacation savings account. I have gotten refunds back for auto insurance policies a couple times. Both times that money went straight to the designated vacations account. Do the same for any other refund, rather that’s tax refunds or returned store items).

The point of this list is you actively seek reasons to save money specifically for your next family vacation that you would have otherwise wasted somewhere else.8. OT and Holiday Pay

I love this next one because it motivates me to work extra hours and make more money doing the same amount of work. This only works for you if you have a job instead of owning your own company of course.

Whenever I receive holiday pay for paid holidays or I work OT the money goes in the vacation savings account. This adds up quick since I receive time and a half for overtime.

During holidays I receive double pay for working overtime which is an added bonus incentive for working OT on these days.

9. 5%-10% Back-Up Savings Direct Deposit

I love out-of-mind-out-of-sight money. From every paycheck I direct deposit 5% into a third savings accounts. (Yes, I am a big fan of separating funds, I hate to mingle funds).

The truth is a save money so many different ways that I start to lose track.

So guess what happens when I check on my third savings account months later?

I find $500 plus!

Now I don’t have to use this for vacation, unless I want, but this provides me extra money and ends up as one of my favorite frugal money saving ideas on this list.

10. $1-$5 Daily Savings Challenges

Can you save $1 a day?

Even if you cannot reasonable do this daily then at the end of the week or each paycheck transfer or pull the cash out to drop in your jar towards your family vacation savings.

Do not mix the #5 and #10 of our frugal money saving ideas here. The coins you find or receive as change go to the change jar. This idea here only pertains to you proactively pulling money aside.

The Challenge Part…but fun for the whole family

To add a fun incentive to this involve your whole family (unless your kids are very young). The person who sticks to the challenge of saving the most money wins a prize (non-monetary) like extra dessert for a week, no chores for a week, a massage, extra TV time, etc.

If your kids earn allowances then this can help them practice discipline to save towards a bigger goal.

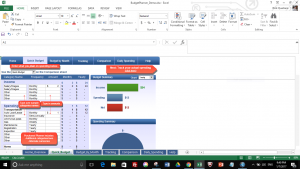

Simple Vacation Budget Spreadsheet and Savings Tracker to Help You Stay on Target

If you want to make sure all your frugal money saving ideas go from thought to hitting their target than I strongly suggest a tracking system.

You can create your own free household budget planner with Excel if you know how to do it, otherwise I came across this simple Excel budget tracker and spreadsheet a while ago. It’s better than the spreadsheet I created for myself (and I can handle myself pretty well on Excel).

The points I like most about it are:

- You can set a monthly expense budget to set spending limits by categories.

- Track income amounts weekly, bi-weekly or monthly and then calculates it for the month and the whole year.

- The spreadsheet automatically calculates expense data monthly and annually.

- Pie charts and bar graphs appear on right side to track income and expenses in a more visually appealing way.

- The budget sheet will indicate in red if you go over budget and green if you stay on budget target.

- Customize your categories to your life.

- It’s inexpensive. If you do not know how or want to take the time to create a complete household budget spreadsheet than use this spreadsheet year after year for a less than $20 one time investment. (This includes free technical support too.)

Download a free demo here to take it for a free spin.